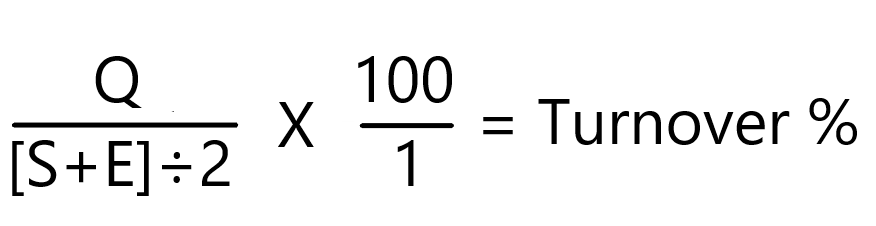

This will give more attention to the cost of materials. Inventory turnover will be more refined if the labor cost and other overheads are removed from the cost of goods. The cost of goods is reported on the income statement. Other factory overheads can also be included. It can include the cost of raw materials and labor costs required for making the goods. The cost of goods sold is the production cost of goods and services that the company produces. Here average inventory is used because companies may have higher or lower levels of inventory at different times of the year.įor example, some companies would likely have a higher inventory before a certain holiday period and lower inventory levels after the holiday.Īverage inventory is usually calculated by adding the inventory at the start and inventory at the end of a given period and dividing this by two. Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory To calculate this ratio cost of goods sold is divided by the average inventory for the same period. It details how much inventory is sold within a period, commonly a year. It shows how successfully a company is managing its inventory. Increasing share turnover is the responsibility of an issuer’s investor relations officer.The inventory turnover formula is also known as the inventory turnover ratio or the stock turnover ratio. Split SharesĬonduct a stock split to reduce the price per share, which makes it more affordable to investors. Otherwise, shares issued are not available for sale. Register as many shares as possible with the Securities and Exchange Commission. Only having one class of common stock makes more shares available to investors. Convert Preferred StockĮncourage investors holding preferred stock to switch over to a single class of common stock. Otherwise, only a small portion of the total number of shares issued will actually be available for sale.

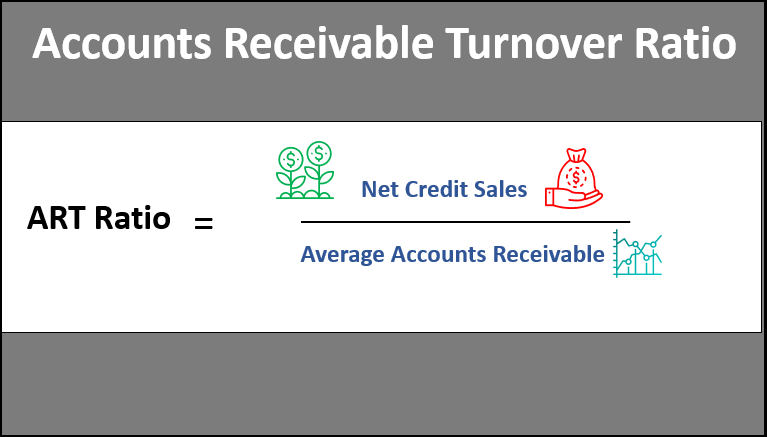

Break Up Large HoldingsĮncourage anyone holding large blocks of stock to sell off some of their holdings. This also means companies should move up from smaller regional exchanges to larger ones, where the stock will be available to more investors. Listing on a stock exchange opens up additional investors who are constrained by their purchasing rules from purchasing unlisted shares. For example, if 10 million shares are sold in one year and the average number of shares available during that period was 1 million, then there is 10x share turnover.Ī company can improve its share turnover by the means noted below. To measure share turnover, divide the total number of shares traded during the measurement period by the average number of shares available for sale. A low turnover rate is relatively common for smaller businesses that have a small market capitalization. Consequently, many investors are unwilling to put their money at risk by acquiring the shares of a company that has a low rate of share turnover. This is a significant measurement for investors to be aware of, for a low share turnover rate indicates that it may take time to sell off a share holding, during which time the shares may decline in value. If there is a high level of share turnover, this indicates that investors have an easier time buying and selling their shares. Share turnover compares the volume of shares traded to the number of shares outstanding.

0 kommentar(er)

0 kommentar(er)